Let me introduce you to my nemesis best friend debt free inspiration…Dave Ramsey. I’ve mentioned him a lot lately, and many have you responded, wanting to know our “debt” story.

I’m sharing it with you because hearing the stories of others is what inspired us to become debt free. My hope is that those of you who are drowning in debt right this very second will be inspired as well. I hope that you will see a light at the end of the tunnel. Ours was a long, long, very dark tunnel. :)

We are not debt free…yet. We’ve been working on it for about three years. The start of our massive debt started almost exactly sixteen years ago – the month I started my first year of college.

I went to school that fall not knowing exactly how I was going to pay for it. I had some help from the government in the form of grants, and I had a part time job that made a little, but those together were not nearly enough to cover everything.

My mother had no money. My father had no money. (My parents were divorced.) My home life was not good – and I had done all of the prep for college on my own – registration, picking out classes, applying for financial aid, etc. I had NO idea what I was doing and really didn’t give much thought as to how I would pay for the THOUSANDS I was supposed to shell out that first year. ;)

All I knew is I was going to college. It was a dark time in my life and I needed control of my life, needed to control my own destiny -- and getting that education simply had to happen. At the time, I very much felt like my life depended on it. (Dramatic, but true.)

If you’ve been on a college campus in the first few months of the school year, you’ve seen the credit card companies out en masse – promising free money in the form of a shiny new credit card to kids who make little to no money. I figured I would use it for back up – it would only be a few hundred bucks at most, right? So I applied for one card, got it. Another one. Got it. Another? Got it.

And I got a free t-shirt each time! Or, even better, a two liter of Pepsi! WHO, I ask, could resist that? ;)

Now, when I look back, I am thankful for those credit cards, because when the first bursar’s bill came due, I went to the ATM and withdrew from each card. Enough to pay my college bill…and I did it every few months for ten months.

After that first year, the balances were growing out of control, and I realized I couldn’t keep up. So I applied for school loans and got them. But by then, I had been living with credit cards for a year, and was HOOKED.

Remember -- I was young. No one had taught me how to handle money. No one had talked to me about debt. We had NO money at home for such a long time, and these little cards were magic to me. I could spend, and then only pay $15 a month and all was just fine.

I didn’t go crazy – but when my school loans ran out each semester, and the part time job money was gone, I went to the cards. It became an addiction. I truly believe I was addicted to credit cards. And then the you-know-what hit the fan and the calls started.

Suddenly I didn’t have enough to pay the minimum payment on all of my cards. So I paid one, and not the others. And the others called. Then I’d pay those, and not the other, and the other called. I was late on all of them, above my balance on all of them, and it was a very scary time in my life.

The credit card companies would call and harass me, all day long. They yelled at me and mocked me when I cried and said, NO, I had no one I could go to for the money. (I hear they’ve changed the laws on what they can say and how often they can call.) They threatened, and I was scared out of my wits. Finally one day I realized I had do something.

I went to a credit counseling service while I was still in college, and it was one of the best days of my life. They sat with me, went through all of my bills, and set up a payment I could deal with. (One payment that was dispersed to all of my cards.) The service called my cards and got my interest rates lowered, late fees frozen, and I started to get control of my life again.

Let me clarify one thing – this service was FREE. There are credit services that charge for this service and I’ve not heard good things about them. The people I worked with were a not-for-profit agency and they helped me more than I can even express to you.

Fast forward years from that time, and I was still paying off those cards. It was slow, but I was doing it. One day I decided to get my credit report, to see my progress. Then I saw something that helped to turn things around even more -- I found a department store card I had applied for and had forgotten about.

It was the ONE card I had left that I could still use – my credit was so bad I couldn’t get any new cards, and the current cards I had were frozen. So I called that store, got a new card and went and charged twenty dollars on it. And paid it off. Did it again, paid it off. For months.

My credit got better and better. Then, I had student loans I was paying off as well. So I paid those on time. And it helped. I actually was able to get a car loan (with a crazy high interest rate, but it was a loan!) and I paid it on time.

Slowly, I was repairing my credit. But did I stop using it? Nope. I don’t know why I hadn’t learned any better. Maybe it’s because I was making a decent living and living comfortably? Maybe it’s because I was still addicted to credit and had the mindset of someone who is addicted – it’s not that bad, I can control it, blah blah BLAH.

Enter my future hubby, who had created a ton of debt on his own. He had done it over time, even longer than me. And we continued to live like that for years. Then we decided to build a house. I took a second job and we worked our butts off to save for a decent down payment – and we had a little leftover for some new furniture. ;)

But as I’ve mentioned before, we moved into a house with lots of rooms and very little furniture. And I kept getting the itch to fill each space…some of it was big stuff, like the dining room furniture. Some of it was small, like a file cabinet from Bombay Company. But it all added up.

I had learned nothing. Nothing.

Years of harassing calls, years of crying, years of growing debt (again), years of not knowing how to tell myself NO.

I guess I should say “we” – both my hubby and I were equally to blame.

About five years ago, while traveling through the state for my job, I came across a radio talk show that caught my attention. (I LOVE talk radio.) People were calling into a show to talk to some guy named Dave, asking about and talking about their debit issues. And this Dave, in his southern drawl, would bring them back to reality in a hot second…calling them out and making them take responsibility for their lives and their money.

I was intrigued. I went home and couldn’t stop thinking about it. So the next trip, I searched the radio again, and found it again. I was hooked. I came home and mentioned it to hubby. We talked about it, daydreamed about it, but never took any action because it was too overwhelming. We were in it SO DEEP.

Then Mr. Dave’s show came to our local radio, and I listened every day. On Fridays, people would call in and tell Dave how much money they had paid off. One couple I remember in particular had paid off $168,000 dollars. (That’s THREE zeros peeps.) Some callers had paid all but their house. Some had paid everything.

They had NO debt. Nothing. Utility bills and retirement were their monthly expenses. And at the end of their call, they would count down, 1…2…3…and scream “We’re debt free!!!!”

And I would cry for them. Because I wanted to be them, because I was so happy for them, because I wanted to be grown up just like them.

So we started. My husband was still a bit hesitant, but we bought Dave’s book and he read it within a few hours. We were hooked. We were ready. We were SO EXCITED.

We’ve been at it for about three years now. We don’t follow Dave Ramsey’s plan to the T – no rice and beans, beans and rice. ;) If we did follow it exactly as he lays out, we would probably be debt free by now. But we have become more strict on ourselves with each passing month. The closer we get, the less we spend, the more we pay off. The more being debt free becomes a reality. :)

Because my husband runs his own business, we may keep one credit card for those expenses after all is said and done. That will most likely be the Amex that we will have to pay off every month. But we also figure that if the rest of our debt is gone (all but the house that is), we probably won’t need it anyway.

We’re not rice and beans, more like macaroni and cheese. And lots of Goodwill. ;) No more new furniture. Even if we can pay for it in cash – we put the money towards cards. No large purchases. No new cars. We rarely go on vacation. (Most trips we do take are for hubby’s work.) We are paying for my stepdaughter’s college education – NO LOANS. And the gift we are giving her by doing that is overwhelming to me. I know she appreciates it, but I know she will truly appreciate it in about 15 years.

Yes, we splurge sometimes, and that’s another way we don’t follow the Ramsey plan exactly. But we pay for our splurges. They don’t sit on a credit card for six years. And they don’t end up costing us 3.5 times more than they originally did. ;)

We work on one credit card at a time, and when another one is paid off, we are like little kids. Giddy.

Paying off credit is so much more fulfilling than spending money we don’t have.

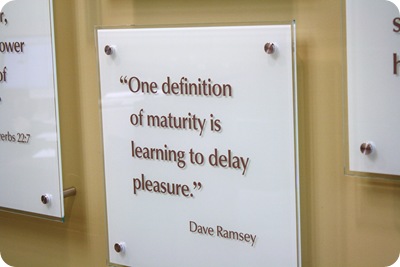

It is JOY. Pride. It is delayed gratification. It makes me feel like an adult. :) And it has created SO many possibilities for our family. Dave Ramsey talks about the new way of life you create for the generations of your family after you… and that is so true. When we are debt free, we will be able to save for our children, mentor them, lead by example and then one day pass along what we have saved to them.

It is exhilarating. It makes me want to cry at what is possible for our family without this monkey on our backs.

So how much have we paid off?

In the past three years, we’ve ridded ourselves of approximately $60,000. Actually, that’s probably pretty conservative. It’s car loans, credit cards, department store cards, student loans, furniture loans, you name it.

It took a long time to create it all, and it’s taking a long time to pay it all off.

We still have a big chunk to go. I won’t say how much till we’re done – don’t want to jinx anything. :) But we are pretty sure we will be debt free by the end of this year, if not in a few months.

The thought of it makes me so emotional. When we pay that last payment, it will be the first time in my adult life I will be debt free. It is overwhelming. And fantastic. And so worth it. I cannot even express to you how worth it it will be.

And the day we make that last payment, we will call in to Dave Ramsey’s show and scream

WE’RE DEBT FREE!!!

And I will cry.

I’ll let you know when that day comes too. ;)

P.S. If you want to know more about Dave Ramsey, click here.